What is an Airdrop?

An airdrop is a distribution of tokens to users under pre-set conditions. A project allocates part of its token supply and shares it with participants to quickly attract attention, build a community, and expand the number of token holders. In 2026, airdrops remain one of the most straightforward ways to receive crypto assets without buying them directly, especially when participation happens via centralised exchanges.

The core idea is simple: you meet the conditions (for example, holding a specific asset, trading a required amount, or joining a special event), and then receive tokens as a reward. After the tokens are credited, you can hold them (if you believe the project may grow) or sell them (to lock in profit).

Why do projects run airdrops?

An airdrop is both marketing and a launch strategy. Projects use token distributions to:

- attract new users and boost awareness,

- create an “initial distribution” so the token ends up with many holders rather than a small group,

- stimulate activity (trading, deposits, campaign participation),

- kick-start an ecosystem: tokens may be needed for fees, voting, access to features, or internal rewards,

- build liquidity and interest around a listing.

How to earn from airdrops via CEX exchanges?

Exchange-based airdrops are valued for their practicality: fewer technical steps, clear rules, and rewards credited straight to your exchange account.

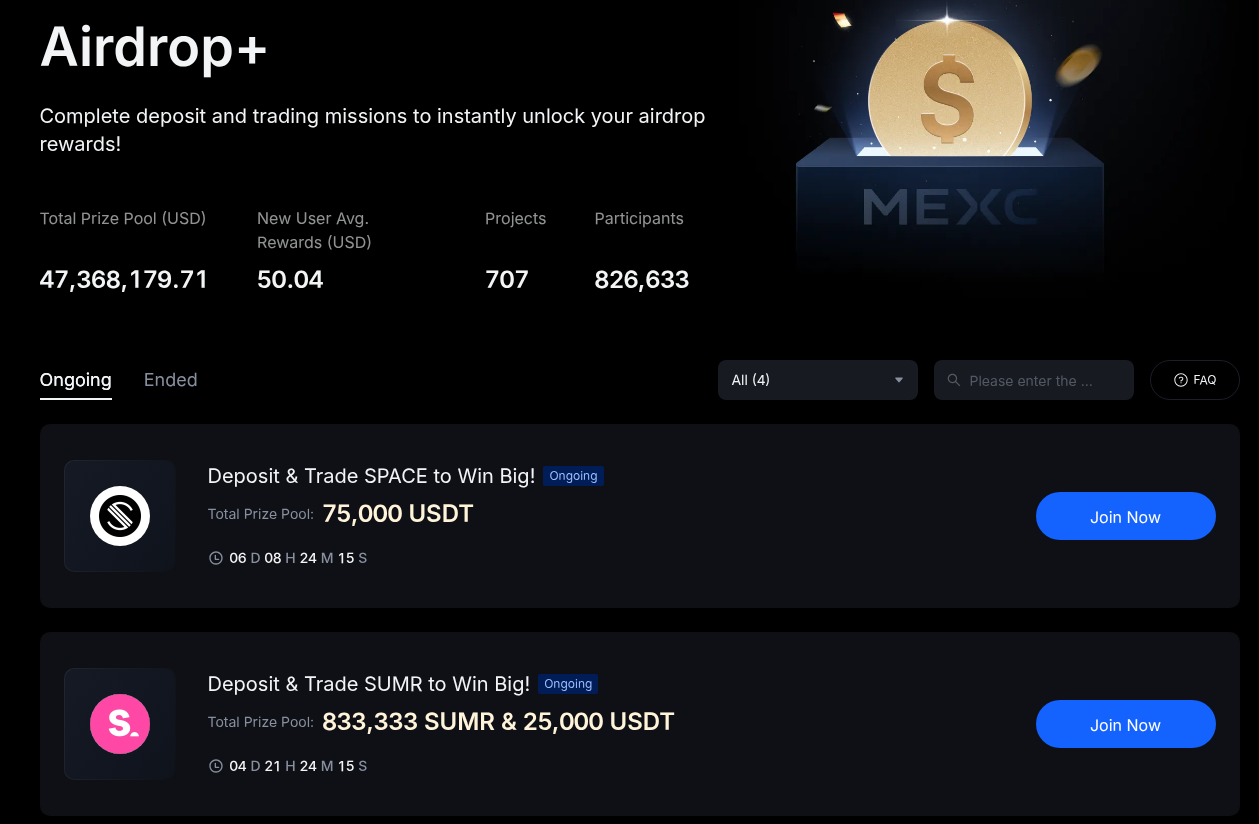

To join an airdrop, you need to register on MEXC:

MEXC: https://promote.mexc.com/r/Rl72m1XG

Event Centre → AirDrop+ → join

Main conditions to receive an AIRDROP:

Holding airdrop (Holding)

You must keep the specified asset on the exchange for the entire campaign period and not let your balance drop below the required minimum (if set). The exchange takes balance snapshots over time or on a specific date, then automatically credits rewards to users who meet the conditions.

Trading activity (Trade-to-earn / Volume-based)

You need to trade the specified pairs and reach the required trading volume during the campaign (or fall within the distribution rules based on turnover). After the event ends, the exchange checks your volume and credits the tokens automatically.

Deposit / top-up (Deposit-based)

You must deposit the specified asset/token to your exchange account within the campaign window and meet the minimum amount requirements (and sometimes a minimum holding period for the deposit). The exchange then confirms eligibility and distributes rewards to your balance.

Task-based events (Tasks / Campaigns)

You open the campaign page and complete a checklist before the deadline: these may include account actions and event participation, explicitly listed in the rules. After the campaign ends, the exchange verifies completion and credits rewards to participants.

Benefits of joining an airdrop

- Potential profit without buying the token directly. Sometimes allocations can be worth a noticeable amount, especially in a strong market.

- Accessibility. Exchange participation is usually simpler: no need to deal with wallets, networks, or on-chain fees.

- Diversification. You can receive different tokens and spread risk across projects.

- Early access. Airdrops are often tied to a launch and listing — you may receive the asset at the start of peak market interest.

Downsides and risks?

- Profit isn’t guaranteed. The token price can drop quickly after distribution (often due to mass selling).

- Conditions can be “expensive”. If trading volume is required, fees and volatility risk can eat into returns.

- Capital lock-up. In holding formats, your funds may be tied up for a set period and exposed to market swings.

- Limits and rules. Campaigns may have participant caps, region restrictions, account requirements, and minimum volumes.

- Project quality varies. Some tokens are weak and have little real utility — the reward may end up being symbolic.

Who are airdrops best for?

- Those willing to follow rules with discipline (deadlines, requirements, caps).

- Those who manage risk and don’t “chase every token”.

- Those who prefer the exchange format: simpler, faster, and without unnecessary on-chain hassle.

Summary

In 2026, airdrops remain a practical tool: projects distribute tokens to accelerate audience growth and activity around a launch. By joining airdrops via MEXC, you can earn rewards and monetise them with a sensible strategy — but it’s important to understand this isn’t “guaranteed income”. It’s a model with risks, primarily market and operational.