What is EARN?

Earn is an umbrella term for sections on exchanges where users can generate returns on crypto assets without “classic” trading. It usually covers interest for holding, staking, taking part in new project launches, auto-deploy/automated strategies, and products with fixed terms.

It’s important to understand the basic logic of Earn products: you either make an asset available to a protocol/exchange (staking, lending), lock in yield terms for a period (locked products, dual-investment), or join incentive programmes (launchpool/launchpad). Yield is almost always a function of risk and liquidity.

View Earn on the exchanges:

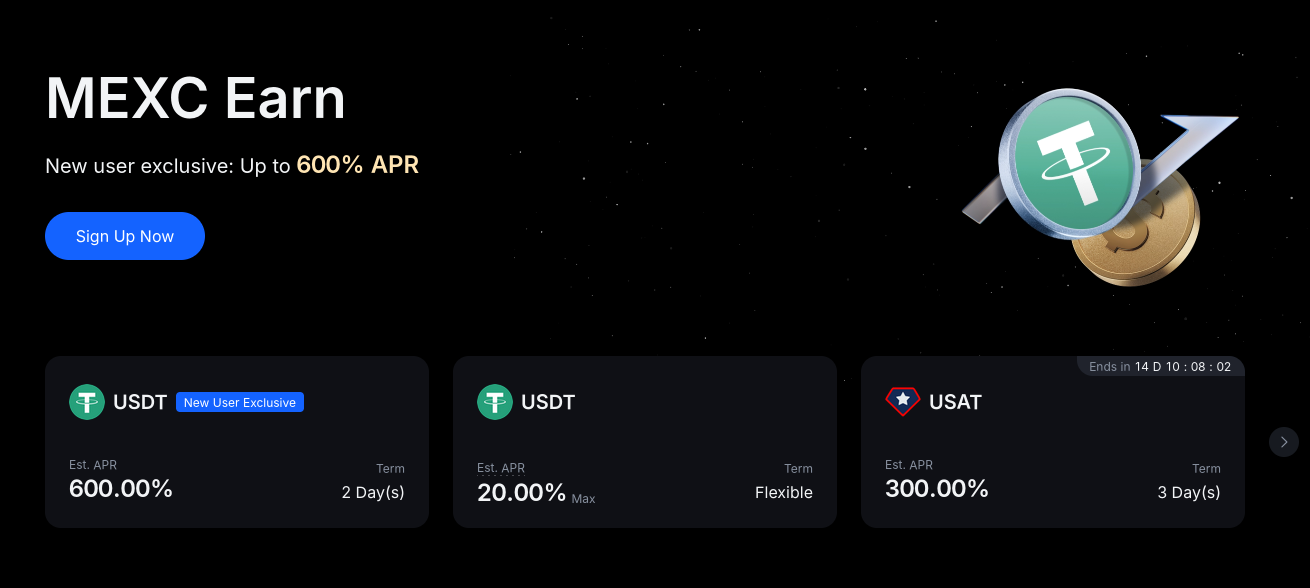

MEXC https://promote.mexc.com/r/Rl72m1XG

HTX https://www.htx.com/invite/ru-ru/1f?invite_code=c94e8223

CoinW https://www.coinw.com/ru_RU/register?r=26184209

Toobit https://www.toobit.com/ru-RU/register?invite_code=YyhCwb

Earn: the core idea and where the yield comes from

The most common Earn income sources are:

- Protocol rewards: staking in PoS networks, restaking, liquid restaking.

- Interest from borrowers: crypto lending/borrowing.

- Marketing incentives: launchpool, airdrop campaigns, holding bonuses.

- Risk/option premium: dual-investment and similar products where yield is tied to possible execution at a price.

A single “Earn” interface often bundles multiple mechanisms, so read terms carefully: two products with the same “APY” can have fundamentally different risk.

Flexible Saving: flexible interest accounts

Flexible Saving is a format where you can usually deposit and withdraw at any time (or with minimal delay). The rate is typically lower than fixed products because liquidity is harder for the provider to plan.

Who is it for?

- Anyone who values quick access to funds.

- “Parking” funds between trades.

- Keeping reserves for fees and fast transfers.

Key risks

- The rate is variable and can fall.

- Instant withdrawals may be limited during stress periods.

- Platform risk (exchange/custodian) and smart-contract risk if the product is on-chain.

Locked staking: fixed lock-up for higher yield

Locked Staking is staking or a deposit where the asset is locked for a term (e.g., 7/30/90 days). Because liquidity is predictable, yields are often higher than flexible alternatives.

Benefits

- Higher rate.

- Easier to forecast returns.

Downsides

- Reduced liquidity: early exit may be impossible or may forfeit part of rewards.

- Asset price risk: the asset is locked while the market can move sharply.

Staking: classic staking and ETH staking specifics

Staking is allocating coins on Proof-of-Stake networks to support consensus and earn rewards. On exchanges, staking is often “wrapped” into a convenient product: the exchange aggregates validators, credits rewards, and sometimes charges a fee.

Where does the yield come from?

Consensus rewards, network fees, and protocol mechanics.

General risks

- Platform risk (if staking via an exchange).

- Protocol/validator risk: penalties, downtime, slashing (network dependent).

- Liquidity risk when lock-ups apply.

ETH staking

ETH staking is often treated separately because it commonly includes:

- Entry/exit waiting periods (queues, delays).

- Liquid forms (e.g., “staked ETH” tokens) that add liquidity but introduce de-peg and smart-contract risk.

- Reward mechanics where yield combines issuance rewards and fees/MEV (depending on implementation/infrastructure).

Launchpad and Prime Launch: new project launches

Launchpad is a platform for initial token distribution of new projects, usually with participation conditions: holding an exchange token, completing tasks, lotteries/allocations.

Prime Launch is often positioned as a “premium” variant with stricter requirements, a different allocation format, or priority for certain user categories.

What to keep in mind:

- Allocation is almost always limited: you may meet conditions and still receive a small share.

- High volatility risk: after listing, the token can spike or drop sharply.

- Project risk: the product may underdeliver and tokenomics may be weak.

Launchpool active: farming tokens by locking/holding

Launchpool is a format where you “stake” a popular asset (often the exchange token or a stablecoin) and receive rewards in a new token for a limited period.

When you see “Launchpool active”, it usually means:

- A campaign is currently running.

- Rewards accrue in real time or on a schedule.

- There are entry/exit windows and minimum amount rules.

Benefits

- You can often exit relatively quickly (depends on pool rules).

- Exposure to a new project without buying at launch.

Downsides

- Yield falls as more participants join.

- Rewards can depreciate quickly after listing.

You can usually find this in Earn/Earnings sections:

MEXC https://promote.mexc.com/r/Rl72m1XG

HTX https://www.htx.com/invite/ru-ru/1f?invite_code=c94e8223

CoinW https://www.coinw.com/ru_RU/register?r=26184209

Toobit https://www.toobit.com/ru-RU/register?invite_code=YyhCwb

Crypto loans: lending and borrowing

Crypto loans in the Earn context typically involve two roles:

- Lending (supplying): you provide assets and earn interest.

- Borrowing: you take a loan against collateral and pay interest.

On centralised platforms this is often an internal pool; in DeFi it’s smart contracts with over-collateralisation.

Key risks:

- Liquidation risk (for borrowers): if collateral value drops, positions can be closed.

- Rate risk: rates are dynamic and depend on supply/demand.

Dual-Investment: yield with a price condition

Dual-Investment offers a higher yield but with a condition: on the expiry date, your asset may be converted into another asset at a pre-set price (strike).

In practice, it’s similar to selling an option: the higher yield is the premium for the risk that you end up with a different asset than you wanted, or at a price that’s unfavourable versus the market.

When can it make sense?

If you’re happy to buy/sell at a specific price and want to earn a premium while waiting.

Main warning

This is not a “risk-free deposit”: the outcome depends on price movement.

Liquid restaking: restaking with liquidity

Restaking is a model where the same base stake (or a derivative token) is used to secure additional infrastructure/services (depending on the ecosystem). Liquid restaking adds liquidity: you receive a substitute token that can be deployed in other strategies.

Upsides

- Potentially higher yield via extra rewards.

Risks

- Risk stacking: base protocol + restaking layer + smart contracts + de-peg risk of the derivative token.

- Harder to assess true yield and where rewards come from.

Earn on futures balance: yield on futures account funds

Some platforms offer Earn yield on unused balance in the futures wallet. It usually works like this:

- Automatic placement of idle funds into low-risk instruments (often stablecoin yield),

- While keeping margin available for positions (with caveats under the rules).

What to check

Whether this conflicts with margin requirements.

How quickly funds become available during sharp market moves.

Any withdrawal limits while positions are open.

NFT market inside the Earn ecosystem:

An NFT marketplace isn’t always a classic Earn tool, but it’s often included as part of the ecosystem via:

- Trading venue,

- “Hold-to-earn” mechanics (rare and project-dependent),

- NFT staking or NFT pools (on certain platforms),

- Launchpad/mint events.

Risks

- Liquidity: selling an NFT can be difficult.

- Price discovery is less transparent than for tokens.

- Higher fraud/copy/manipulation risk, especially in illiquid collections.

Earn add-ons: Auto-Invest, Auto-Earn, Auto-subscribe, Earn-suite

Many platforms add “layers” that don’t change the product’s nature, but automate management.

Auto-Invest

Automatic buys on a schedule or rules (DCA-style): you set asset(s), frequency, amount. It may sit inside Earn, but it’s investment automation rather than an interest product.

Benefits

- Reduces emotion and timing bias.

- Convenient for long-term accumulation.

Auto-Earn

Automatic allocation of idle balance into suitable Earn products (typically flexible deposits or short-term tools). Goal: prevent funds from sitting unused.

Risks

- It may switch products internally (rates/limits/terms); understand the auto-transfer rules.

- Instant access may be restricted during stress periods.

Auto-subscribe

Automatic subscription: for example, auto-renewing a locked term or automatically joining new pools/campaigns based on your parameters.

Practical value

- Minimises manual actions, especially when products end/restart often.

Earn-suite

Earn-suite usually means a “bundle/showcase” of products: one interface, unified yield display, sometimes portfolio-style allocation logic.

Key point

“Suite” is packaging. Real risk is determined by the specific tools inside.

How to choose an Earn product for your goal

If you need quick access to funds:

Flexible Saving, Auto-Earn (only with high liquidity and clear withdrawal rules).

If you’re willing to lock assets for higher yield:

Locked staking, fixed/locked products.

If you want to support networks and earn protocol rewards:

Staking, including ETH staking (understanding exit times and liquid-form risks).

If you accept new-token risk for potential upside:

Launchpad, Launchpool (especially during active campaigns).

If you need a collateralised loan or want to earn by lending:

Crypto loans (lending/borrowing), with caution around platform risk and liquidations.

If you trade potential upside for a premium:

Dual-Investment (only if you understand the price scenario and accept conversion).

Universal Earn risks to state explicitly

- Liquidity risk and potential withdrawal limits.

- Risk of rate/term changes.

- Market risk of the underlying asset (especially in locked formats).

- Compounded derivative risk (liquid staking/restaking).

All exchanges where Earn is available:

MEXC: https://promote.mexc.com/r/Rl72m1XG

HTX: https://www.htx.com/invite/ru-ru/1f?invite_code=c94e8223

CoinW: https://www.coinw.com/ru_RU/register?r=26184209

Toobit: https://www.toobit.com/ru-RU/register?invite_code=YyhCwb